A very good read from a respected source!

FT. Jensen Huang, Nvidia’s ‘Napoleon’ sees the chip company soar.

As its market value rose above $3tn for the first time, one of the last founder-CEOs remains firmly in control.

07 June 2024

Elaine Moore and Michael Acton

Jensen Huang’s entrance at this year’s Nvidia conference had all the trappings of a pop idol performing in their hometown. Demand was so high that some attendees abandoned overcrowded coaches and resorted to running through downtown San Jose to catch the chief executive’s speech. As they searched for empty seats in the 11,000-capacity arena, the music swelled. Huang walked forwards, dressed in his trademark black leather jacket, and joked: “I hope you realise this is not a concert.”

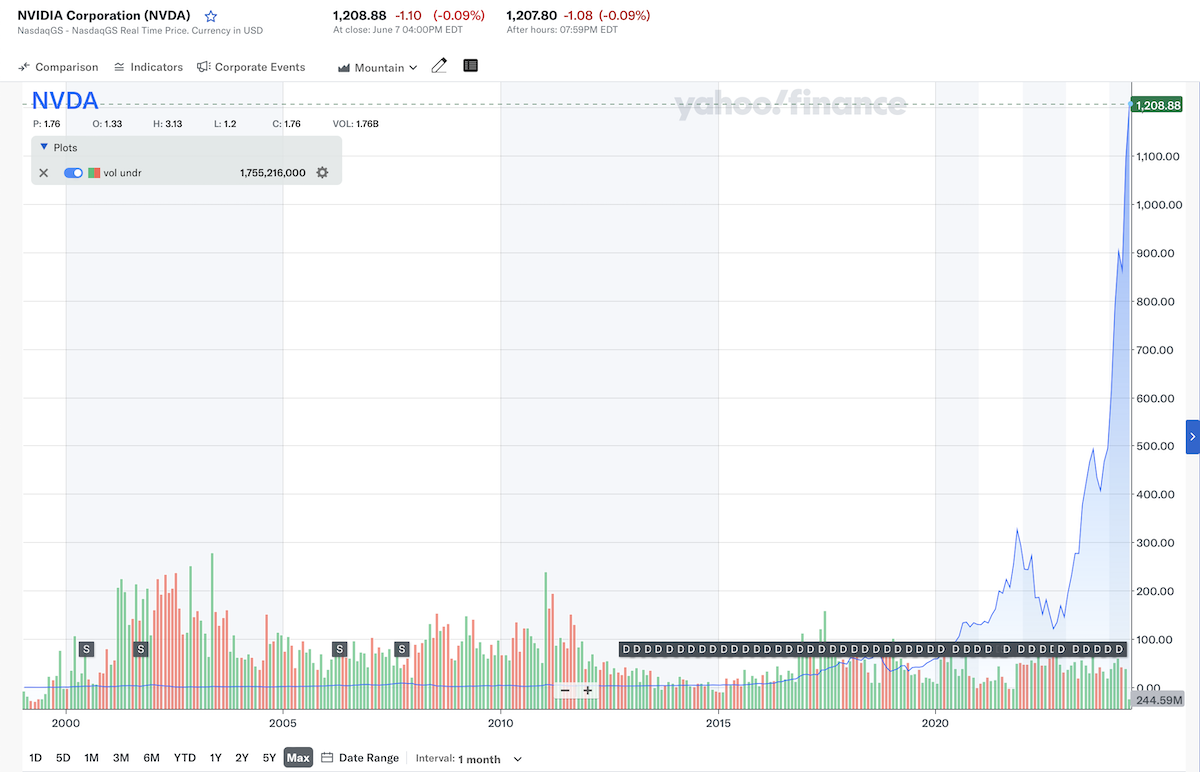

Over the past 18 months, Huang’s bet on artificial intelligence chips and software has turned Nvidia into one of the most powerful companies in the world. This week its market value briefly rose above $3tn — only the third company in history to do so.

Huang is on the cusp of becoming a household name, joining the likes of Elon Musk and Mark Zuckerberg as one of the few tech CEOs the public can recognise. But even Musk has never been filmed signing a woman’s top, as Huang was this week.

If he seems to relish the attention, that’s because it has been a long time coming. Huang co-founded Nvidia in 1993 at the age of 30 and has remained at the helm for more than three decades. At 61 he is one of the last remaining founder-CEOs in Big Tech.

“Jensen is an absolutely singular brew of kindness, intensity, ambition and relentless determination,” says Patrick Collison, CEO and co-founder of payments company Stripe. “He is Napoleon reincarnated with a big heart and a passion for semiconductor wafers.”

Demand for ever faster, more powerful chips has been compared to a global arms race, one that Nvidia is helping the US to win. But even the US is not immune to shortages. Supply is constrained by capacity at TSMC, the sole Taiwanese company that produces the cutting-edge Nvidia chips driving AI breakthroughs.

Nvidia chips are therefore regarded as a matter of national security. Meanwhile, antitrust enforcers are circling. This week, Jonathan Kanter, head of the US justice department’s antitrust division, told the Financial Times that regulators were looking at the competitive landscape of chips.

Nvidia’s CEO is unlikely to be surprised. In Huang lore, greatness can only come from suffering. Chris Gibson, chief executive of AI drug discovery firm Recursion, which Nvidia invested in last year, recalls him offering some bracing advice during their first meeting. “He said, ‘Every start-up is in a constant state of death.’ You are always fighting against death, and you are always fighting for relevance.”

Huang attributes his resilience to his childhood. Born in Tainan in southern Taiwan in 1963, he arrived in the US at the age of nine and became the youngest boarder at a school in rural Kentucky. After graduating from high school early, he attended Oregon State University to study electrical engineering, where he met his wife, Lori. The pair then moved to Silicon Valley and found jobs in the booming semiconductor sector.

This was a time when venture capital was flowing, PC sales were flying and semiconductor companies were experimenting with outsourcing manufacturing to Taiwanese companies. Along with two friends, Huang hit on the idea of creating a company that specialised in designing computer chips able to render realistic 3D video game graphics. They named their start-up after the Latin for envy, invidia.

The early years were difficult. Only the success of the RIVA 128 graphics card, launched in 1997, saved the company from bankruptcy. Nvidia listed in 1999, shortly before the dotcom bubble burst. It went on to survive a share price crash in the financial crisis.

“Building a company, and building Nvidia, turned out to be a million times harder than any of us expected it to be,” Huang told the Acquired podcast last year. “If we had realised the pain and suffering and just how vulnerable you’re going to feel and the challenges that you’re going to endure and the embarrassment and the shame and the list of all the things that go wrong, I don’t think anybody would start a company.”

Part of Nvidia’s survival may come down to its unusual structure. Rene Haas, chief executive of UK chip designer Arm, worked there in the early 2010s and says Huang has built an organisation that prioritises projects over typical management hierarchies. This allows him to reach down to any layer of it to get the answers he needs. “It’s a very unique culture,” says Haas. “The benefit of that is transparency and speed. And I think that is one of the things that Nvidia is really, really good at. They move very, very fast, they’re very, very purposeful.”

Huang sees the job of CEO as someone who works on the things that nobody else can or does. In 2006, Nvidia started developing CUDA, the software ecosystem that helped to expand the use of its graphics processing units beyond gaming. The advent of generative AI, which supercharged sales, validates that strategic shift. Nvidia has cornered a highly profitable market for the data centre chips that power the training and implementation of massive AI models used by companies such as OpenAI.

Despite his length of tenure, no successor has been identified. And Nvidia’s product release schedule is still speeding up. Blackwell, a more powerful AI chip, has just launched but the next generation is already in the works. When the time comes, expect Huang to be the person on stage who announces its release.